The Greek economy, as

most people know, is at its worst condition for the last 7 – 8 years due to a

recession, its huge amount of debt, lack of liquidity due to wage and pension

cuts, unemployment and taxes. Under the memorandum Greece signed last summer,

it agreed to meet some criteria in order to avoid an exit from the Eurozone. I

am not going into further details, but the pending agreement, still pending, is

taxes, taxes and taxes. The middle class is being eroded, not to speak about

the lower income class.

Since Greece entered into

this never ending loop, government officials talk about investments. But for

investments to take place, a serious and credible nation must have a stable tax

code, for its citizens as well as for attracting investments. And the Greek

government is bragging about investments. But if you do not have a stable and

acceptable tax system, as well as a manageable debt, investments will not reach

the horizon.

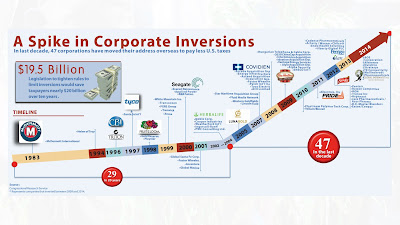

Corporate Inversion is used

by corporation by relocating to a foreign country having a lower tax laws. As a

result, the operating body of the company remains unchanged, its legal

headquarters change, as is its tax obligation. Many companies have relocated

their headquarters to benefit from saving taxes. A case in point is Bulgaria

and Cyprus, where many companies are relocating. Recently, Greek ship owners

announced that they would relocate to Cyprus since their tax rate is at 12%.

The benefits of corporate

inversion is that by changing its legal headquarters to a foreign location, it

is no longer required to be subject under the tax code on foreign earnings. It

is subject to pay taxes on earnings earned on is base country. The other

benefit is that being a multinational, it is able to make a loan to its

subsidiary back home. This process is called earnings stripping. According to

Investopedia, this is a common practice used my multinationals to escape high

taxes at home. So is there an insane investor who will come to Greece and

invest in such a climate of uncertainty and high taxation?

The multinational company

will make a loan to its subsidiary back home, and the subsidiary will take

advantage of the tax deduction of interest payments. The deduction in earnings

will have a domino effect to the overall earnings since interest payments in

the US, for example, are tax deductible.

The consequences of these

somewhat unethical practices, is that capital is fleeing the country. It is not

due only to economic instability but political or currency risk, or even in

situations where capital controls are being imposed. All three were the cause

for a mass of capital exodus from the Greek banks in the summer of 2015, which

led to capital controls, and the closing of Greek banks. Capital controls are

still in effect.

Some interesting data facts are presented here below:

According to Wikipedia,

it is interesting to read the history of capital flights where in the 1990’s it

was observed in the Asian and Latin American countries. Examples were Argentina

in 2001, on the fears that the country would default. Another interesting case

was in 2006 in France (irony) when the government announced that it would

impose a wealth tax. In 2012, the Spanish central bank announced that in Q1

2012 there was an exodus flow of capital in the amount of 97 billion euros

(influenced by the Greek crisis).

Bill T. Alexandratos