Here is another interesting perspective on negative interest rates. The central bank of Canada is considering such a monetary policy. Negative interst rates means good and bad news.

On the banks, it means they would have to pay the central bank for their reserves, and the good side, force them to provide liquidity to the economy.

For depositors it could mean increased bank charges. The article appears in The Globe and Mail, and the link is http://www.theglobeandmail.com/report-on-business/economy/what-are-negative-interest-rates-and-how-do-they-work/article27669897/

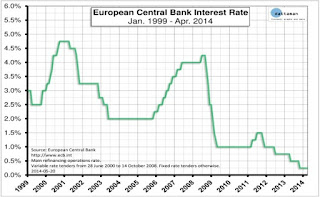

The continued problem with stagnation in Europe has led the ECB to lower interest rates to zero levels to stimulate growth. The low interest rates has a positive effect on exports in Europe. It has helped devaluate the euro currency, thus making exports cheaper.

The US federal funds rate stands at 0.25% while other countries have even lower rates. Israel's benchmark rate is at 0.1%, the euro area rate is at 0.05%, Japan's discount rate is at 0%, Switzerland at -0.75%. The effects of low interest rates on the currency also has an impact. Low interest rates makes a country's demand for its currency to decrease. Investment on that currency is unattractive, while a weaker currency stimulates exports to rise, while it could be unattractive for banks to lend, for example mortgages, since negative rates will make it unprofitable for banks, thus lend less.